EUR/CHF Stalls Near 0.9847, Neutral Outlook Holds

Quick Look

EUR/CHF consolidates around 0.9847, with a neutral short-term bias.

Key support at 0.9709; a break above 0.9847 may signal a bullish trend continuation.

Watch for a bearish divergence in the four-hour Moving Average Convergence Divergence (MACD), suggesting a possible pullback.

The medium-term outlook remains positive as long as the fifty-five-day Exponential Moving Average (EMA) at 0.9625 holds.

Geopolitical tensions and U.S. inflation data impact EUR/CHF dynamics.

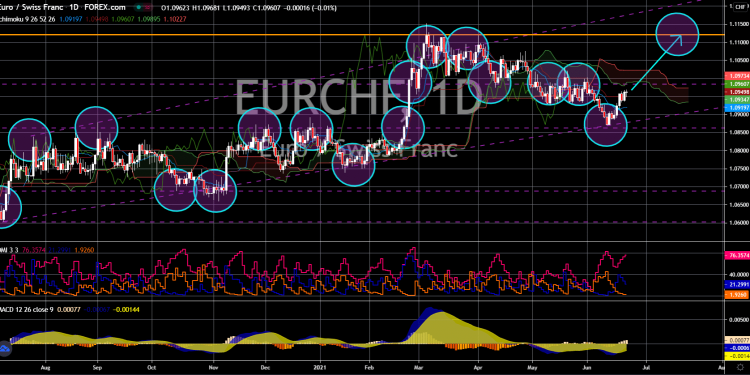

The EUR/CHF currency pair continues its phase of consolidation, hovering around 0.9847, with the intraday bias remaining neutral. As the market assesses various economic indicators and geopolitical tensions, traders and investors are closely monitoring the support and resistance levels that will dictate the short-term movements of this pair.

Technical Analysis of EUR/CHF and Support Resistance Levels

In the near term, the outlook for EUR/CHF appears bullish as long as the 0.9709 support level holds.

A break above the recent high of 0.9847 could signal the continuation of the upward trend from the 0.9252 low, pointing towards a more significant recovery in the medium term. However, traders should be wary of the bearish divergence observed in the four-hour MACD, which suggests the potential for a short-term topping pattern. Should the pair break below the 0.9709 support, it could lead to a deeper pullback, shifting the bias back to the downside.

The larger picture suggests that a medium-term bottom may have been established at 0.9252, supported by a bullish convergence in the weekly MACD. Should this bullish sentiment persist, the pair’s next target could be the thirty-eight-point-two per cent (38.2%) Fibonacci retracement of the downtrend from the two thousand eighteen (2018) high of 1.2004 to the two thousand twenty-three (2023) low of 0.9252, which sits at around 1.0303. This scenario remains favoured as long as the fifty-five-day EMA, currently at 0.9625, holds as support.

Geopolitical Influences and Economic Indicators

The currency markets are not only influenced by technical indicators but also by global economic and geopolitical developments. Recent minutes from the Federal Reserve’s meeting highlighted ongoing concerns about elevated inflation levels, with the data not convincingly pointing towards a sustained move towards the two per cent target. This scenario supports a higher-for-longer interest rate environment in the U.S., which indirectly impacts the EUR/CHF through its effect on USD/CHF dynamics.

Moreover, the geopolitical landscape, particularly in the Middle East, continues to influence market sentiment. Tensions between Israel and Iran have escalated following recent incidents, including threats and political rhetoric from both sides. These developments could drive safe-haven flows towards the Swiss Franc, traditionally viewed as a refuge in times of uncertainty. The outcome of ceasefire talks between Israel and Hamas also remains a critical factor that could influence the Swiss Franc’s strength in the near term.

As traders navigate through these complex dynamics, several factors will come into play. Firstly, the interplay between technical thresholds will be crucial. Secondly, external economic and geopolitical factors will significantly influence the direction of the EUR/CHF pair in the coming weeks. Consequently, investors should stay alert. They should watch for any shifts in the macroeconomic landscape or sudden geopolitical developments. These changes could sway market sentiment and potentially trigger significant currency movements.

The post EUR/CHF Stalls Near 0.9847, Neutral Outlook Holds appeared first on FinanceBrokerage.