Nvidia stock rose early on Wednesday as investors welcomed signs of progress in the company’s access to the Chinese market, easing a key overhang that has weighed on the stock for months.

Optimism around continued funding momentum for artificial intelligence development, including potential capital backing for ChatGPT-developer OpenAI, also supported sentiment toward the chipmaker.

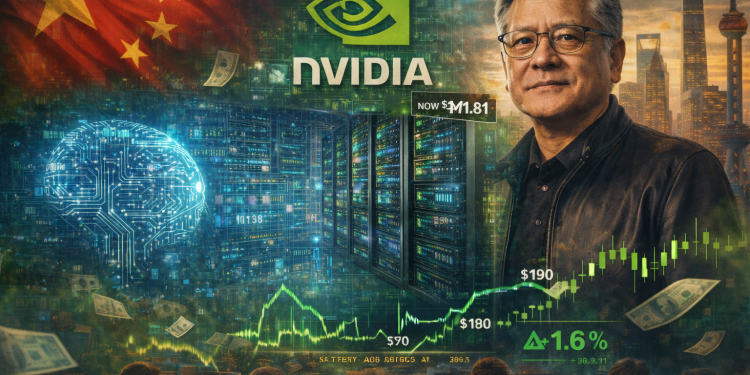

Nvidia shares were up 1.6% at $191.81 in early trading, pushing the stock toward the upper end of a range between roughly $170 and $190, where it has largely traded since early November.

The move raised expectations that the stock could break out of that range if positive news flows around China and AI spending continues.

China clears first H200 imports

The rally followed a Reuters report that China has approved its first imports of Nvidia’s H200 artificial-intelligence chips, marking a notable shift after months of regulatory uncertainty and tight scrutiny of advanced US-made hardware.

According to the report, which cited people familiar with the matter, Chinese authorities granted clearance for several hundred thousand H200 chips during a visit to China this week by Nvidia Chief Executive Officer Jensen Huang.

The approvals were said to be concentrated among three large Chinese internet companies, with additional firms lining up for later batches.

The move suggests that Beijing is balancing its push to develop domestic AI capabilities with the immediate need for advanced computing power to support data centres and large-scale artificial intelligence projects.

Easing stance reflects near-term AI needs

The decision represents a meaningful easing after months of mixed signals from Chinese regulators, who have repeatedly emphasised self-reliance in semiconductors while also grappling with the practical constraints facing domestic developers.

Chinese AI companies have faced growing bottlenecks in training and deploying large models due to limited access to high-performance chips.

Nvidia’s H200 is widely viewed as the most powerful AI processor China can realistically obtain under current US export restrictions.

According to the Institute for Progress think tank, the H200 offers roughly a 32% processing-power advantage over Huawei’s Ascend 910C, currently the most advanced domestically produced AI chip.

That performance gap has made Nvidia’s hardware highly sought after by Chinese developers racing to keep pace with global advances in artificial intelligence.

Range-bound trading may be ending

Nvidia stock has been range-bound for several months, as investors weighed strong global AI demand against geopolitical and regulatory risks tied to China.

The lack of sustained progress on Chinese sales has been a key reason the shares struggled to push meaningfully higher, even as Nvidia continued to report strong results elsewhere.

Wednesday’s news provided one of the clearest indications yet that the China issue may be moving toward resolution, at least partially.

That has prompted some investors to reassess the stock’s near-term trajectory.

With shares now approaching the top of their recent trading range, a confirmed pickup in Chinese shipments could serve as a catalyst for further gains, particularly if it coincides with continued investment in AI platforms globally.

The post Nvidia stock in the green after China chip approval reports: can it keep going higher? appeared first on Invezz