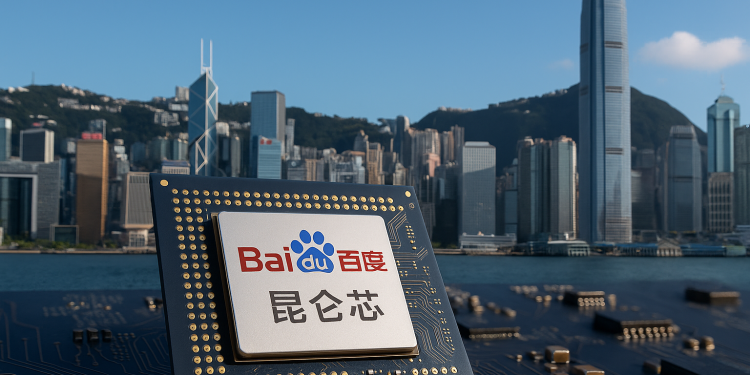

Baidu is exploring a Hong Kong listing for its Kunlunxin AI chip arm, as per a Bloomberg report.

The move comes at a time when Beijing is intensifying efforts to reduce its reliance on US hardware, and companies across the sector are trying to strengthen their position in a market reshaped by sanctions.

Early talks around the listing highlight growing interest in homegrown chipmakers as demand for AI computing continues to rise.

Hong Kong listing plans gain traction

As per the report, Baidu is considering a potential listing for Kunlunxin in Hong Kong, with discussions still at a preliminary stage.

Kunlunxin is valued at least $3 billion, although the timeline and size of the IPO remain unclear.

News of the deliberations first surfaced on Friday, prompting Baidu shares to climb as much as 7.8% in Hong Kong, marking the sharpest rise since 17 September.

The possibility of a listing adds a new layer to China’s AI chip strategy as local firms aim to position themselves against global suppliers.

China’s wider push for AI chip strength

Kunlunxin designs accelerators used in servers across data centres, placing it among a small group of Chinese firms building technology essential for AI training and inference.

Their work has become central to Beijing’s long-running ambition to move away from dependence on US technology, including chips offered by Nvidia.

Companies such as Huawei Technologies and Cambricon Technologies are playing a major role in this shift and are expected to increase output significantly in 2026.

Rising demand from firms including Alibaba and DeepSeek is driving this acceleration as local players scale their AI services.

Market momentum boosts domestic chipmakers

Investor enthusiasm for Chinese semiconductor firms was visible on Friday when Moore Threads Technology surged more than 500% during its debut.

The strong reception reflected expectations that local chip developers may climb the value chain despite ongoing US restrictions.

These moves are taking place against the backdrop of mounting global competition in advanced computing, where access to high-performance chips remains crucial for companies racing to build AI models.

The performance of Moore Threads also underscored the pressure on domestic players to deliver products capable of replacing Nvidia’s widely used accelerators.

Kunlunxin’s role in Baidu’s future

Kunlunxin was created to support Baidu’s heavy computing needs across its online services.

It now sits at the centre of the company’s long-term strategy to expand its AI capabilities and strengthen control over its technology infrastructure.

Bloomberg notes that JPMorgan analysts last month highlighted the chip unit, together with Baidu’s cloud division, as key growth drivers for the company.

Their report suggested that the pace of transformation across Baidu’s operations may be moving faster than some in the market expect.

As AI adoption widens, the company’s internal chip ecosystem is becoming increasingly important for ensuring stable and efficient access to processing power.

The post Baidu eyes Hong Kong listing for Kunlunxin as China pushes AI chip independence appeared first on Invezz